Thanks to Bain for this. http://www.bain.com/bainweb/PDFs/cms/Marketing/rebuilding_big_pharma.pdf.

This interesting and well-researched article basically elaborates an emerging trend for companies moving from the FIPCO model (fully integrated pharmaceutical company where the company owns R&D and sales plus all other components along the supply chain) through to one of partnerships (which I have called frienships for alliterative journalistic purposes) where companies partner with other specialised companies with each partner concentrating on their core competency. In the case of many big pharma companies it can be argued that their core competency is late stage phase III clinical trials and then sales and marketing.

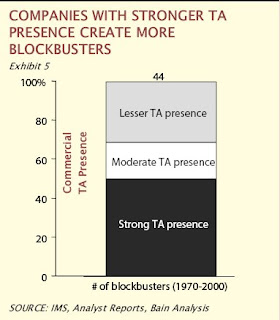

Somewhat entertainingly the likeness with the movie industry is made where large 'blockbuster' (see what they did there) movies are made by several partnering studios.

Amazingly this model for business operations states that the big companies should also sell early stage discoveries if they are not discoveries that align themselves with the core competencies of that company. So the buyer eventually becomes a vendor also (this is central to the model that many estate agents operate). The converse is also true I have heard that successful small cap companies may want to buy in new early phase stock once they have completed a successful sale.

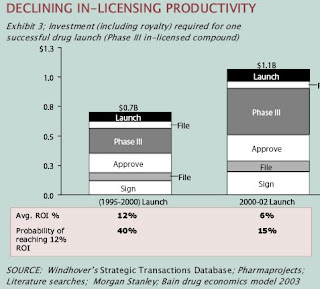

The article also sounds a word of warning. At first the warning is pretty dire because they illustrate the declining productivity associated with in-licensing deals. This is however fairly explicable in terms of early adopters and low hanging fruit etc. I believe however that the examples of declining producitivity associated with in-licensing are a further argument in favour of greater transparency and a more open trading exchange. Here then I am going back to my original concern i.e. the current system is archaic and allows for all sorts of light corruptions. (apologies this graph will have to come later when the website is running properly again).

No comments:

Post a Comment